Tổng quan về thương mại điện tử (TMĐT)

Trong số sáu thị trường TMĐT nổi bật ở Đông Nam Á, Philippines có giá trị thương mại điện tử thấp nhất mặc dù đây là đất nước có số dân cao thứ hai trong khu vực.

Với dân số 107 triệu người, Philippines có hơn 76 triệu người dùng Internet. GlobalWebIndex báo cáo rằng 75% những người dùng Internet trong độ tuổi từ 16 đến 64 tuổi đã từng mua sắm trực tuyến.

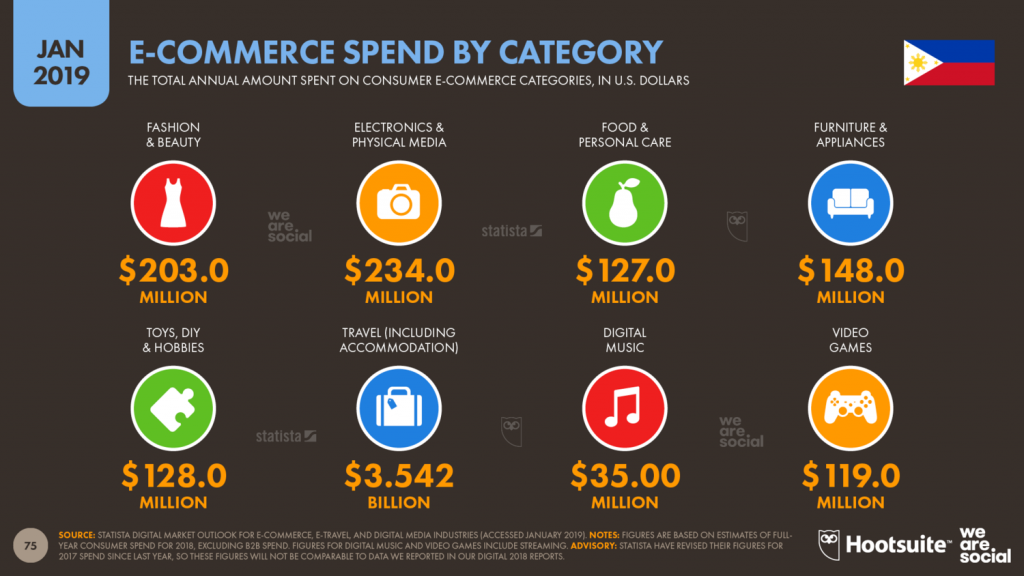

Năm 2019, trang web Wearesocial và Hootsuite đã đánh giá giá trị ngành TMĐT của Philippines nằm trong khoảng hơn 4,5 tỷ đô la. Con số này thể hiện mức tăng trưởng cao hơn 16% so với năm ngoái, thấp hơn mức trung bình của khu vực là 21%, nhưng cao hơn mức trung bình toàn cầu 13%.

Tuy nhiên, ngành du lịch chiếm phần lớn giá trị trong khi hàng tiêu dùng chỉ chiếm 840 triệu đô la. Điện tử & thiết bị là ngành hàng chiếm tỷ trọng lớn nhất, tiếp theo là thời trang & làm đẹp và nội thất & gia dụng. Tất cả các ngành hàng tiêu dùng đều tăng trưởng nhanh với tỷ lệ trung bình là 22%.

Người Philippines vẫn chưa có niềm tin vào việc mua sắm trực tuyến, họ chỉ tiêu trung bình 20 đô la trong suốt cả năm.

Có thể thấy rằng Philippines đang là một thị trường thương mại điện tử sơ khai với đầy tiềm năng chưa được khai thác, mặc dù quốc gia này có tỷ lệ sử dụng Internet cao. Tin tốt là tốc độ tăng trưởng của thương mại điện tử tại đây luôn ở mức hai con số, và eMarketer dự đoán rằng đất nước này sẽ sớm trở thành một trong những thị trường tăng trưởng nhanh nhất trong những năm tới.

Yếu tố thúc đẩy

- Sự gia tăng của tầng lớp trung lưu: World Bank báo cáo rằng Philippines là một trong những nền kinh tế mới nổi ở khu vực Đông Á với mức tăng trưởng hàng năm là 6,3% từ năm 2010 đến 2018. Quốc gia này đang trên đường trở thành một quốc gia có thu nhập trung bình cao ở tương lai gần. Tỷ lệ nghèo và bất bình đẳng thu nhập cũng đang giảm dần, nhường chỗ cho tầng lớp trung lưu phát triển với khả năng chi tiêu mạnh mẽ.

- Sự hỗ trợ của chính phủ: Năm 2016, chính phủ Philippines đã công bố Lộ trình thương mại điện tử trong giai đoạn 2016-2020 với mục tiêu chính là tăng giá trị của các hoạt động kinh doanh trực tuyến lên 25% GDP của đất nước này vào năm 2020, tăng 10% so với năm 2015. Tập trung vào phát triển 6 khía cạnh chính: cơ sở hạ tầng, đầu tư, đổi mới, tài sản trí tuệ, luồng thông tin và tích hợp; Chính phủ Philippines đã đưa ra nhiều chính sách có lợi cho người bán hàng TMĐT trên thị trường.

- Thói quen sử dụng mạng xã hội: Với độ tuổi trung bình 25,7, Philippines là một quốc gia có dân số trẻ và am hiểu công nghệ. Những người này là những người sử dụng Internet cường độ cao với 10 giờ 2 phút mỗi ngày, trong đó 4 giờ 12 phút được dành cho mạng xã hội. Sự gia tăng của các thiết bị di động giá rẻ đã thúc đẩy phong trào này, giúp người Philippines có thể dễ dàng được tiếp cận thông qua sự kết hợp giữa các mạng xã hội và nền tảng TMĐT. Hầu hết các nền tảng mạng xã hội nổi bật như Facebook, Instagram và Twitter đều rất phổ biến tại Philippines. Nghiên cứu của PayPal cho thấy 87% người bán hàng đang sử dụng mạng xã hội như là một trong những kênh bán.

- Sự tiện lợi của thương mại điện tử: Những lợi ích của mua sắm trực tuyến đang dần được khách hàng công nhận, bởi sự lựa chọn phong phú về loại sản phẩm và nguồn hàng từ trong và ngoài nước. Đối với một quốc gia nơi 89% người trưởng thành sở hữu điện thoại thông minh như Philippines, cách tiếp cận chủ yếu qua thiết bị di động mà nhiều nền tảng TMĐT đang áp dụng sẽ mang lại trải nghiệm mua sắm tối ưu nhất.

Thử thách

- Thanh toán tiền mặt: Rất ít người Philippines sử dụng hình thức thanh toán online, chỉ 1,9% dân số nước này có thẻ tín dụng và 9,9% từng mua hàng và thanh toán hóa đơn trực tuyến. Do đó, người bán hàng online phải cung cấp dịch vụ giao hàng CoD (cash-on-delivery: nhận tiền mặt khi giao hàng) như một phương thức thanh toán để thu hút số đông. Đây là một điều lo ngại lớn đối với người bán nước ngoài về thời gian nhận tiền và tỷ lệ hoàn trả đơn hàng cao. Tuy nhiên, chính phủ Philippines đã nỗ lực thúc đẩy ngân hàng tăng gấp đôi tỷ lệ chủ sở hữu tài khoản ngân hàng từ 35% lên 70% vào năm 2023 thông qua Chiến lược tài chính quốc gia của mình. Ví điện tử cũng đang xuất hiện ở nước này, với GCash và SMART Money là hai nhà cung cấp dịch vụ chính.

- Công tác hậu cần: Là một quần đảo gồm hơn 7.600 hòn đảo, hậu cần vận chuyển là một thách thức đối với các hãng giao hàng chặng cuối của Philippines. Trong khi cư dân ở thủ đô Manila có dễ dàng mua hàng tại hầu hết các thương hiệu và cửa hàng, thì khu vực ngoại ô và nông thôn có những lựa chọn rất hạn chế. Thời gian vận chuyển cũng khác nhau với 1-2 ngày cho khu vực thành thị và tối đa 7 ngày cho những người khác.

- Kết nối Internet: Internet ở Philippines có kết nối chậm nhất và đắt nhất ở khu vực Đông Nam Á, do đó các thương hiệu phải thực sự chú ý đến việc tối ưu hóa website.

- Niềm tin của khách hàng: Nhìn chung, người tiêu dùng Philippines vẫn còn nghi ngờ các giao dịch online bao gồm TMĐT và thẻ tín dụng. Họ nghĩ rằng những người bán hàng trực tuyến là những kẻ lừa đảo và việc đòi lại tiền sẽ khá khó khăn, trong khi thẻ tín dụng có thể dẫn đến việc “vung tay quá trán”. Các nền tảng TMĐT đang cố gắng thay đổi nhận thức này bằng cách tỏ ra minh bạch nhất có thể và đưa ra những chính sách để bảo vệ người mua trực tuyến.

Thương mại lai

Cơ sở hạ tầng yếu kém là vấn đề của hầu hết các khu vực nông thôn tại các nước đang phát triển, và Philippines cũng không phải là ngoại lệ. Sự kém phát triển của các tuyến giao thông vận tải khiến các công ty hậu cần khó tiếp cận địa chỉ cụ thể làm tăng phí vận chuyển, ngoài ra thời gian chờ đợi cũng khá lâu.

Những người chơi TMĐT tại Philippines đã đưa ra một chiến lược để giải quyết vấn đề này: thiết lập các điểm lấy hàng ở các địa chỉ trung tâm như trung tâm thương mại hoặc cửa hàng tiện lợi để khách hàng đến nhận các sản phẩm họ đặt trực tuyến. Một số nơi thậm chí còn cung cấp dịch vụ mua hàng để hỗ trợ những khách hàng chưa quen với việc mua sắm trực tuyến.

Một ví dụ tiêu biểu là dịch vụ CLiQQ được cài đặt trong chuỗi cửa hàng tiện lợi 7-Eleven. CLiQQ có thể giúp khách hàng thanh toán hóa đơn, đặt vé máy bay và mua hàng trực tuyến. Các mặt hàng được đặt mua sẽ được chuyển đến cửa hàng để khách hàng đến nhận sau vài ngày.

Phương pháp này được gọi là thương mại lai – TMĐT dựa trên các kênh kinh doanh truyền thống. Thông qua thương mại lai, người bán hàng TMĐT có thể tiếp cận hai tập khách hàng vốn ở ngoài tầm với của họ: khách hàng họ không thể giao tới và khách hàng không biết mua sắm trực tuyến. Và khi cơ sở hạ tầng và nhận thức của khách hàng cần thời gian để thay đổi, phương pháp này có khả năng cao sẽ trở thành tiền đề để TMĐT ở Philippines phát triển.

Đăng nhập

Đăng nhập Đăng ký

Đăng ký